Tips to Improve Your Credit Before Buying a Car

Table of Contents

Tips to Improve Your Credit Before Buying a Car

Buying a car is exciting, but your credit score can make the difference between a low-interest loan or higher monthly payments. The good news? Even if your credit isn’t perfect, there are ways to improve it and we can still help you get into a car while you work on boosting your score.

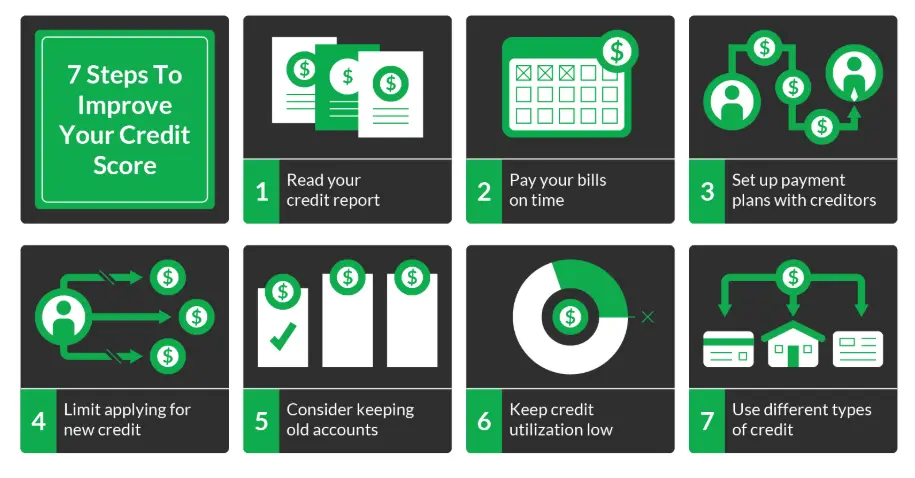

Here’s how to take control of your credit before buying:

1. Check Your Credit Report

Start by pulling your credit reports. Look for errors like accounts that don’t belong to you, incorrect balances, or late payments that weren’t yours. Disputing mistakes can give your score an immediate lift.

2. Pay Down Existing Debt

Your credit utilization is the ratio of what you owe to your total credit limit which matters as well. High balances can hurt your score. Paying down credit cards or other loans not only reduces your debt but signals to lenders that you can manage your finances responsibly.

3. Stay Current on Payments

Consistently paying bills on time is one of the most important factors for improving credit. Even a few months of on-time payments can make a noticeable difference. Set reminders or automate payments to avoid missing a due date.

4. Be Strategic About New Credit

Opening multiple credit accounts at once can temporarily lower your score. Only apply for what you truly need. Each new application should be intentional and part of your larger plan to improve credit.

5. Consider a Co-Signer

If your credit score isn’t ideal, a co-signer can help you get approved and may qualify you for a better interest rate. While a co-signer doesn’t fix your credit, it opens doors while you work on improving your score. It’s a practical option for buyers who want a luxury car now without waiting months to boost their credit. Read More about how a co-signer can help here!

6. Build Positive Credit History

If you have little or no credit history, small steps can help. Making on-time payments on a secured credit card or a small loan creates a positive record that lenders look for. Over time, this history can increase your approval odds and help you secure better financing. Learn more about first time purchasing here!

Bottom Line

Improving your credit doesn’t have to delay your car purchase. At Exclusive AutoHaus, we work with buyers across all credit situations. Whether you’re ready to buy now with a co-signer, or you want to take a few months to improve your score, our finance team will guide you through your options. The goal is simple: get you into a car you love while keeping your finances on track.

📍 Visit us at 1600 S Roselle Rd, Roselle, IL

📞 Call us at 630-501-0698

🔗 Start your pre-approval online today